26+ Borrowing limit calculator

You can open a solo 401k for your 1099 income in 2020. Any purchases or transfers made after the first 60 days will attract interest and a higher 5 fee so diarise the cut off carefully.

Revenue Formula Calculator With Excel Template

This is a result of the time value of money principle since money today is worth.

. The pension plan is also separate. Interest rate and loan limit. Loan amount NOK 2 million Repayment period.

UGMAUTMA 529 Conversion Calculator. By tweaking the loan amount loan term and interest rate you can get a sense of the possible overall costYou will see that as. 239 Effective interest rate.

15k credit limit 5k overdraft 20k Investment property expenses freqDictionarydatatempOthersexpensesinvestmentPropertyExpenses. Our loan calculator will help you generate monthly and yearly amortiztion schedules for any proposed loan. The contribution limit is 56000 in 2019 and 57000 in 2020.

The monthly interest payments on a buy-to-let mortgage depend on various factors. Home loan information and interest rates are current as at 26 August 2022 for new loans only and are subject to change. Select from suggested Mutual Fund schemes and buy Mutual Funds online.

The contributions at County hospital A do not affect your solo 401k contributions. RAMS has created a whole range of free home loan calculators to help you establish your borrowing profile. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

If you get a credit card after 1 January 2019 your credit card provider must also give you the option to cancel your card or reduce your credit limit online. MF Return Calculator Input investment amount and desired time-frame to calculate potential returns on your investments in the particular mutual fund. You can also calculate your monthly repayments and interest rate.

This comprehensive 529 plan comparison tool lets you compare over 40 features including investment options state income tax benefits and more. Find your monthly payment total interest and final pay-off date. Find out how much you could borrow with our calculator.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. There are advantages and disadvantages to all types of. NOK 2 680 990.

As part of a regulatory requirement an independent survey was conducted to ask approximately 1000 customers of each of the 16 largest personal current account providers if they would recommend their provider to friends and familyThe results represent the view of customers who took part in the survey. Total credit card overdraft limit eg. These include the size of your initial loan the rental value of your property and your own financial situationHowever it will also heavily depend on what type of loan you take out be it a fixed rate or variable rate mortgage.

Savings. Use the solo 401k calculator to find out how much you can contribute. Get in touch with our home loan specialists today.

Use this calculator to test out any loan that you are considering. Search Home 529 Plans Compare 529 Plans. A borrowing base is the amount of money a lender will loan to a company based on the value of the collateral the company pledges.

For the first year we calculate interest as usual. The borrowing base is usually determined by a. If you opt out of these over-limit arrangements the card issuer can still allow you to temporarily exceed your limit but must not charge you a fee for doing so.

The lender charges interest as the cost to the borrower of well borrowing the money. 25 years Nominal interest rate. Your 457 contribution is separate.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions. Its an up to card so unless showing as pre-approved in our eligibility calculator you could get just 12 months at 0 andor the higher transfer fee.

So lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate.

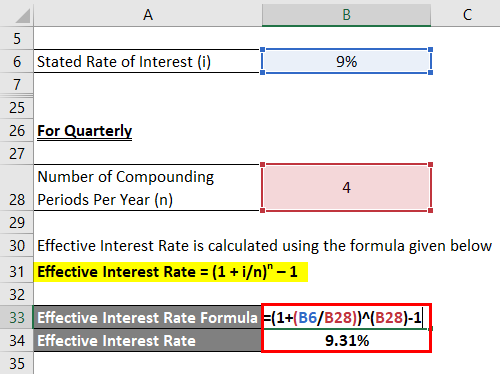

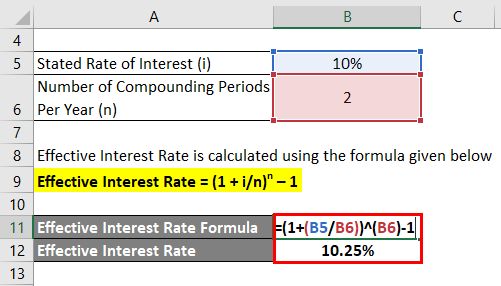

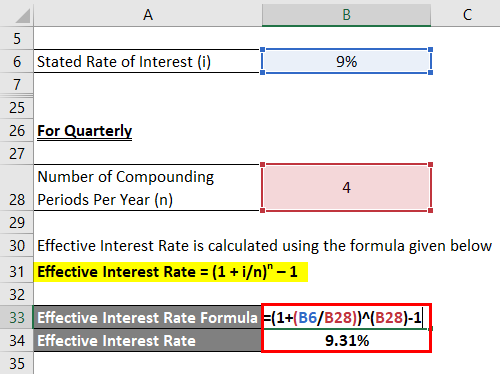

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

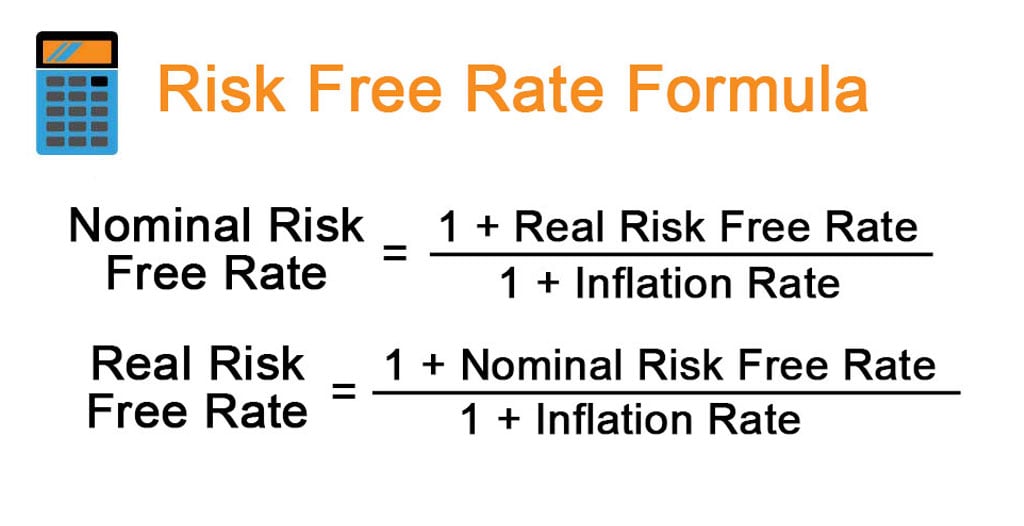

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

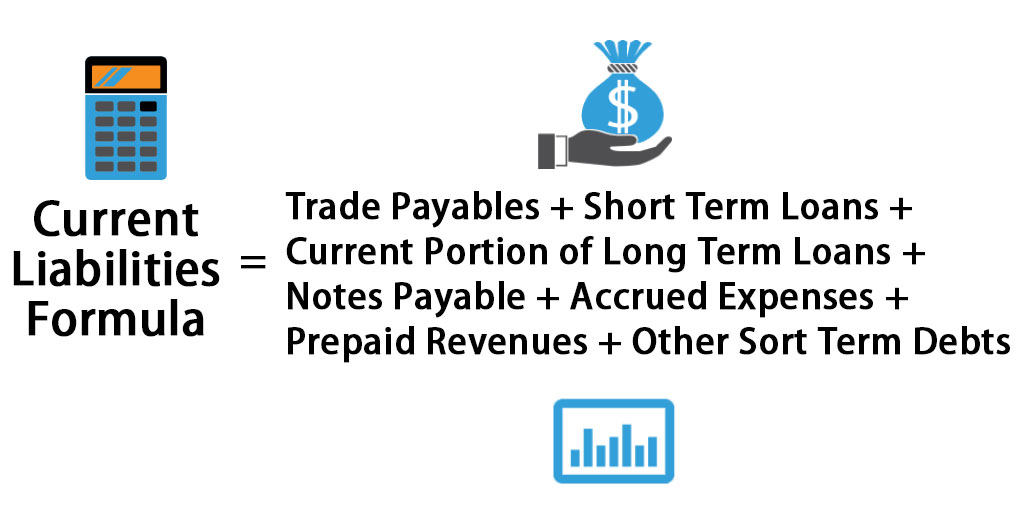

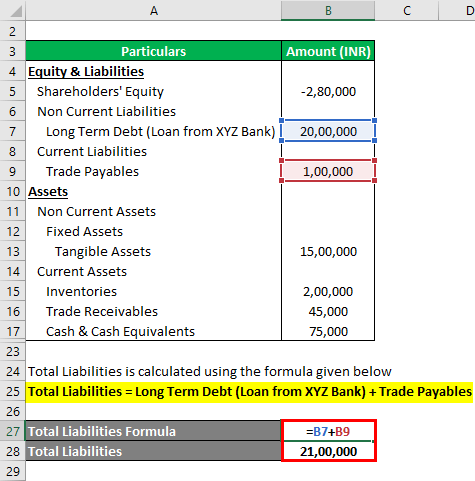

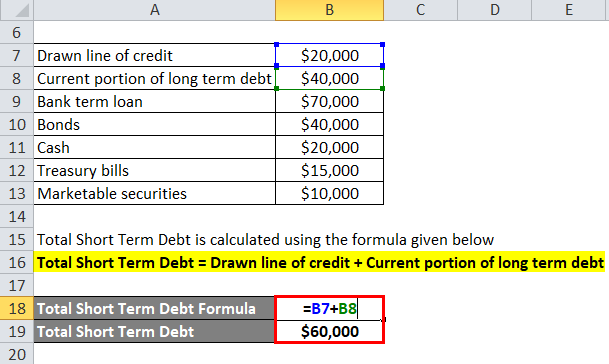

Current Liabilities Formula How To Calculate Current Liabilities

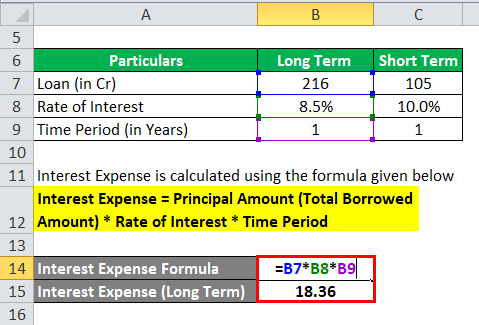

Interest Expense Formula Calculator Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Net Worth Formula Calculator Examples With Excel Template

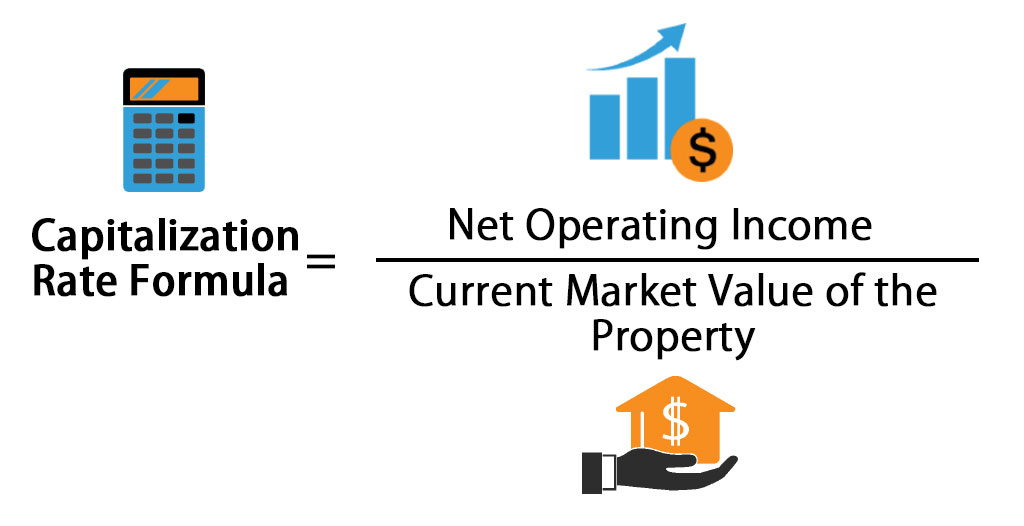

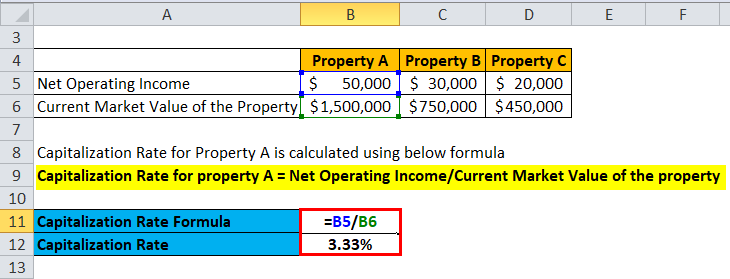

Capitalization Rate Formula Calculator Excel Template

Interest Expense Formula Calculator Excel Template

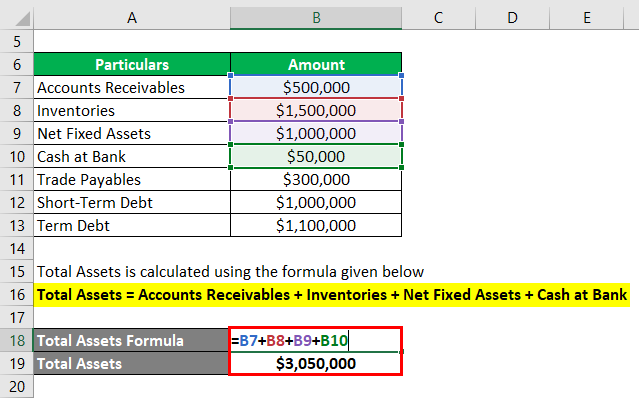

Net Asset Formula Examples With Excel Template And Calculator

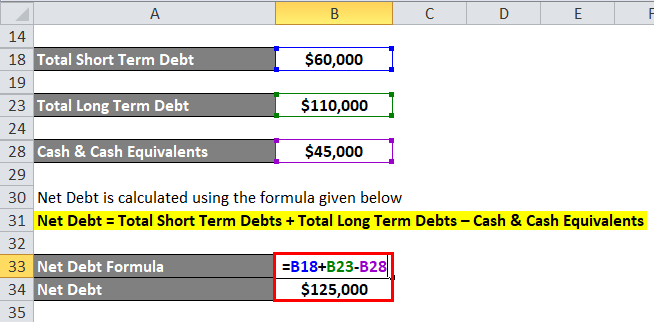

Net Debt Formula Calculator With Excel Template

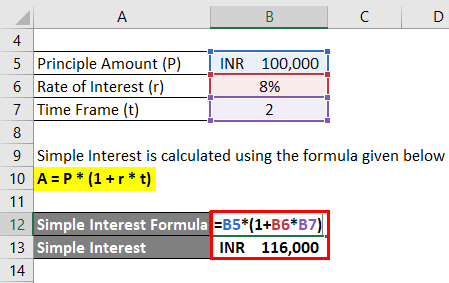

Simple Interest Formula Calculator Excel Template

Owner S Equity Formula Calculator Excel Template

Net Debt Formula Calculator With Excel Template

Capitalization Rate Formula Calculator Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template